Dear Esteemed Professional

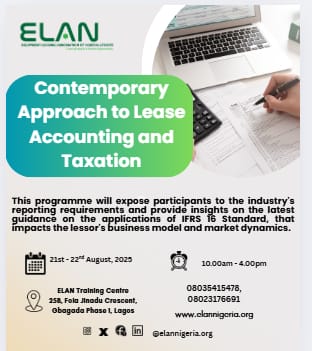

We are pleased to invite you, to a highly interactive programme ” CONTEMPORARY APPROACH TO LEASE ACCOUNTING AND TAXATION” covering latest developments and best practices in lease Accounting and Taxation highlighting the reporting and compliance requirements.

This programme will expose you to best standards in accounting recognition and measurement as well as the latest guidelines on tax implications for leases. It will bring you up-to-date with the industry’s reporting requirements and provide insights on the latest guidance on the applications of IFRS 16 Standard that impacts the lessor’s business model and market dynamics would ultimately.

OUTLINE

●Accounting for Leases

* Accounting Environment: Current Trends and developments

* Direct Finance Lease Accounting

* Sales Type Lease Accounting

* Operating Lease Accounting

* Leverage Lease Accounting

* Impactions of International Financial Reporting Standard (IFRS 16) on leasing

●Tax Considerations and Analysis in Leasing

* Overview of current Tax Administration and Fiscal Policies

* Understanding Tax Laws with direct impact on Leasing:

· Companies Income Tax Act

· Value Added Tax Act

· Capital Gain Tax Act etc

* The concepts and applications of Capital Allowances, VAT, Capital Gain tax, Withholding Tax etc

* Analysis of Federal Inland Revenue Services Guideline (IFRS) on Tax implications on Leasing

* Stamp Duties consideration

* Implication of International Financial Reporting Standard (IFRS 16) and Taxation on Leasing

BENEFITS

* Optimised Tax Planning and Management

* Understand the impact of IFRS 16 on key financial ratios and performance indicators

* Enhanced Compliance with IFRS 16

TARGET PARTICIPANTS

Lease Practitioners, Personnel involved in the Lease processes and those interested in Leasing Business.

Date: 21st – 22nd August, 2025

Venue: ELAN Training Centre, 25B Fola Jinadu Crescent, Gbagada Phase I, Lagos

Fee: Member – N95,500 Non-members – N105,500.00

Time: 10.00am – 4.00pm

FREE TEXTBOOK: EQUIPMENT LEASING AND PRACTICE IN NIGERIA: A COMPLETE GUIDE

Account details: EQUIPMENT LEASING ASSOCIATION OF NIGERIA 0072043164 (Sterling Bank Plc)

08035415478, 08023176691, info@elannigeria.org

Kindly register here: